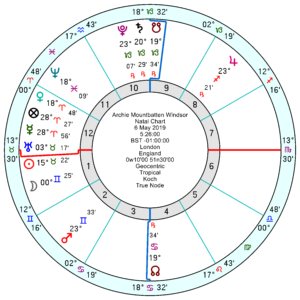

Danny Baker, an English comedy writer and radio presenter has been fired by the BBC for tweeting about the new Sussex baby with a photo of a chimp dressed up in a top hat. The jury is out as to whether it was a piece of mind-boggling stupidity or racism. His excuse was he was trying to draw an analogy between the media fuss around the Royals and animals in captivity. Whichever the BBC had little choice.

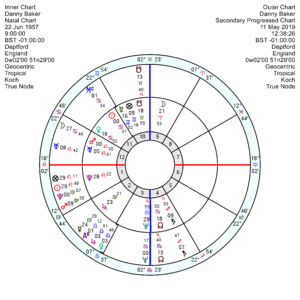

Born 22 June 1957 9am Deptford, England, he has a friendly 11th house Cancer Sun and an explosive, reckless Mars Uranus in Leo in his 12th trine Saturn in Sagittarius; as well as an excitable Aries Moon trine Pluto and opposition Neptune.

At the moment he has his Secondary Progressed Mars exactly almost to the minute of a degree square his Saturn for a car-crash moment; with tr Uranus this year moving in square to his Mars and Uranus, plus their midpoint which looks nerve-stretched and over-reactive. This year as well, not exact, an emotionally exact tr Pluto square his Moon.

Tr Uranus is crossing his midheaven at the moment for a sudden and surprising change of direction career-wise; and tr Pluto and soon tr Saturn will be wading through his 6th house of work for the next several years which sounds like an uphill struggle and then some.

His Solar Return for June 2018 to June 2019 looks downbeat with the Sun opposition Saturn; plus an intense Mercury in the communication 3rd house opposition Pluto square Moon in the 6th house of work leading to misspeaks. And a disruptive Venus opposition Mars square Uranus in the 12th – sudden surges of misplaced enthusiasm.

His Solar Return for June 2019 to 2020 looks worse with a knocked-off-track Uranus in the 10th; and a completely log-jammed and frustrated Mars Mercury opposition Pluto Saturn in the 6th; with a financially worrisome Neptune in the 8th.

There’s no obvious road back from this kind of catastrophic foot-in-mouth blunder.