Pious sentiments about ‘democratising finance’ and sticking it to the rich guys may come badly unstuck for small chat-room investors who sent share prices soaring recently for a moribund Gameshop and lacklustre AMC theatre group. In the process they cost short-sellers a small fortune, before moving on to send the price of silver soaring to its highest level in a decade.

None of the moves had much to do with underlying economic fundamentals which left analysts fearing a sharp reversal for investors similar to the dot-com craze tanking in 2001 and the housing market collapsed in 2008.

On Monday, shares in GameStop, the struggling retailer championed by Reddit investors declined by 30 percent, sliced in half from their peak but still over 1,000 percent higher than where they began the year. One broker said “It’s pump and dump in a totally new, viral format and there are huge risks that need to be looked at right now.” He said it had the markings of a market mania that historically ends in big losses for small traders.

Robinhood, a financial services company, whose game-like approach facilitated much of the rise in GameStop and AMC shares, then had to pull back sharply sparking off criticism. Robinhood may struggle to hold on to its outsider identity as it is forced to play by the rules, industry participants say.

Elizabeth Warren sounded a note of caution. “We actually don’t know who all the players are in all this — whether there’s big money on both sides.”

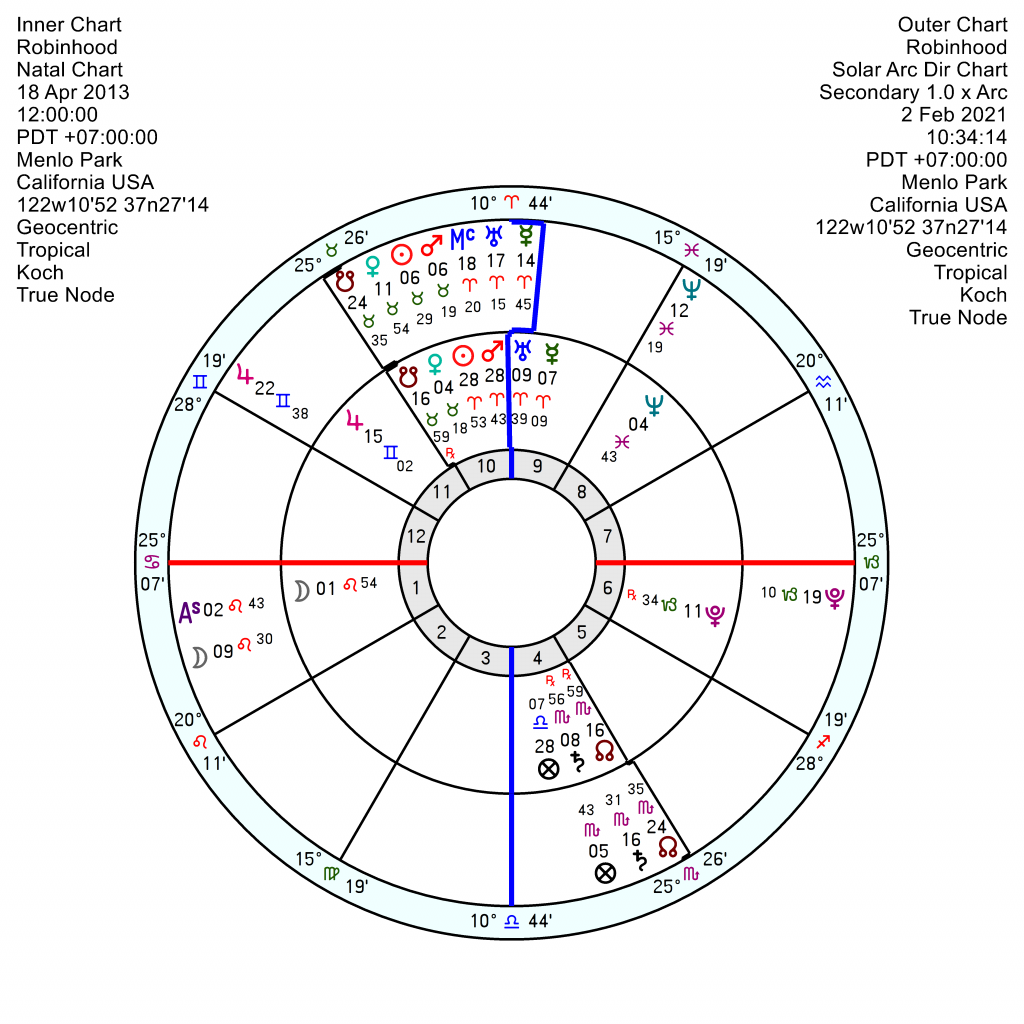

Robinhood was founded 18 April 2013 in California by Vlad Tenev, a Bulgarian-American, and Baiju Bhatt, an Indian-American. It has a fiery, adventurous, pro-active and go-getting Sun Mars in Aries; with an excitable Uranus Mercury also in Aries square Pluto amplifying its innovative, not to say disruptive streak in bucking the status quo. There’s also a more materialistic Venus in Taurus opposition Saturn in Scorpio, so making money will be in its DNA.

This year they will be seriously jolted from mid to late March with tr Uranus opposing its Saturn. But it’s 2022/23 when they will run into the buffers as tr Pluto squares their Mars and Sun to bring them to a grinding halt. With Solar Arc Sun Mars opposing the Saturn in 2023 as well.

It’s not that the finance big boys don’t need a serious sorting out but this could end in tears.

All this stuff is very interesting,since it seems that the stock market is just a adult playground,where it seems adults want to be kids again,not aware of how much they’re causing with other groups of humans,there are a couple of reasons I say this a game to some people is because of one certain astrologers like Micheal munkasey if you look in his book on house keywords he lists the stock market as a 5th house idea,and if uranus is in taurus it squared that house,as well as saturn in aquarius,so it sets up a very interesting dynamic,plus aquarius is ruled by both saturn as ancient ruler of aquarius,and uranus as modern ruler,so it seems like old style investors against new style investors,but in every game some have to lose,and some win,even in games that are creation of wild card uranus,and trickster mercury like the stock market,even more that the creation of uranus/mercury called the internet is taking saturn the guy that sets the rules out of the equation even more,which really driving some of humans,maybe that’s why in star trek time,society they removed money from the equation,except for the ferengi,plus in learning that venus is more than love,it also deals with how we value stuff,and since she’s parenting uranus now in taurus,it seems our values as indepth astrology says as above,as below are being reshuffled at such a frantic pace that what happens next week is anybodies guess,plus with Uranus’s next door neighbor neptune in pisces under the guidance of its old boss jupiter,it seems some of us want to bet the farm,without listening to saturn about teaching us about consequences of our actions,which brings Mars on to the scene since he’s hanging around uranus,so all these points of energy are like a giant pinball,and most of us are trying not to be run over by stuff like this as well as stuff such as covid19,and hopefully we all can all pull through this stuff of constantly shifting phases,and spatial points of these energies around us,since I don’t need to freak out about my future,just do what saturn taught the tortoise against the hare,take it one step at a time,you’ll live longer,and you might reach your goals which were dreams,which is using the best of neptune,and saturn.

Its interesting though, that another astrologer predicted last year that something like this would happen this year. Shes just stated, “This is the share markets for the people, by the people. It will radically change your money by 2026. / It will also help stop Climate Emergency. How? Big businessmen and corporate donors to governments don’t value land, unless they can build on it. Environmentalists want to save land for nature. We’ll see a Robin Hood approach to ‘worthless’ land. Fit only for development, apparently. But green, green, Robin Hood types will plot together to make the value skyrocket. This is a classic Uranus in Taurus (the current cycle) outcome. What was worthless, becomes worth multi-millions through a new game. Essentially green investors will use people power to take ‘cheap’ nature away from developers and preserve it. / For better or worse, what you are seeing with the Robinhood app and specifically the Reddit model of share market rebels in 2021 is the future.”

What do you guys think? Even if these groups implode, are they making way for massive change on the horizon? Are they the prerequisite of what is to come as people start taking their power back away from the 1%?

@Xhsemercury, want to bet a huge percentage of people joining in now are more “traditional” investors ans just curious people wanting to see what the hype is all about?

Anyhow, even if all the new people there were intent to play “play the market”, they’d hardly be able to bust stick market, where biggest players are institutional investors such as various oil funds and pension funds handling savings of tens of millions of people (of these, you should care).

Yes, there will be individuals who’ll suffer, but I honestly think that for those of us who have access to all the information in the internet,

for starters, there’s no excuse for participating to these games, at this point, but greed.

@solaia, the majority of people in this world don’t have, savings, pensions or stocks. They live month by month. This is esp true for millions of millenials. What do they care for yours or the next man’s investment or pension? Nothing. Many are not in any position to accumulate any sort of wealth, just an existence really thanks to the manipulated global financial institutions and low pay paid jobs available today, and I suspect due to covid things will get worse for them. Sadly, I also suspect that wall st will win in the end. However, they are at least exposing the system. I truly empathise with them. The generations after the baby boomers have had it bad financially and work wise. Boomers caring about their pensions/investments only it seems……..

From Wallstreetbets.

“This is for you, Dad.

I remember when the housing collapse sent a torpedo through my family. My father’s concrete company collapsed almost overnight. My father lost his home. My uncle lost his home. I remember my brother helping my father count pocket change on our kitchen table. That was all the money he had left in the world. While this was happening in my home, I saw hedge funders literally drinking champagne as they looked down on the Occupy Wall Street protestors. I will never forget that.

My Father never recovered from that blow. He fell deeper and deeper into alcoholism and exists now as a shell of his former self, waiting for death.

This is all the money I have and I’d rather lose it all than give them what they need to destroy me. Taking money from me won’t hurt me, because i don’t value it at all. I’ll burn it all down just to spite them.

This is for you, Dad.”

There is a certain irony about Hedge Fund managers describing the WSB crowd as “sad and unproductive”. Perhaps they don’t look in the mirror very often as it pretty much describes themselves.

With regard to the current astrological signals Pluto was conjunct Venus in 28 January 2021 in Capricorn. Venus made its ingress into Aquarius at 9.06 a.m EST on 1st February (14.06 UTC). This was just before the NYSE opened at about 9.30. A chart for that event has the Moon representing the people at 1 Libra in the 7th House on the descendant trine Venus in the 11th House. Mars at 12 Taurus in the 2nd House squares the Sun at 12 Aquarius exact and Jupiter at 10 Aquarius. Trickster Mercury is retrograde at 26 Aquarius. All the planets are in the Western Hemisphere of the chart apart from the Moon which is in the Eastern hemisphere. The presence of Mars in both a sign and house ruled by Venus suggests anger and action about financial issues. It should be noted that the Moon in Libra is in the other sign ruled by Venus. The 11th house governs legislatures and governing institutions such as regulators and stock exchanges. The presence of retrograde Mercury and Neptune in the 12th could signify hidden fraud and deception. Uranus the modern ruler of Aquarius is in Venus domain and is still in a close square to Saturn the traditional ruler of Aquarius so there is potential for shock,upsets and rebellion.

Neptune is currently at 19 Pisces which is where Uranus was located in 2008 when the GFC banking crisis occurred. The 19th degree of signs seems to be of some significance for these planets as it is where the last Neptune Uranus Conjunction occurred at 19 Capricorn in February 1993. Neptune and Uranus are in constant dance around the charts and are now about to enter the final semi square in a sequence starting in 2016. Neptune and Uranus semi squares seem to be associated with financial and political turmoil as the previous set was in 1971-74 which coincided with the US ending the convertibility of the dollar to gold, the 1973 oil crisis, Nixon’s impeachment and stagflation. Interesting that the U.K. joined the EEC in 1973 during the first set of Neptune and Uranus semi squares, was forced out of the ERM just before the 1993 Conjunction of these planets and left the EU during the next set of Uranus Neptune semi squares.

Although current events are concentrated around stock speculation I think it may have deeper and longer significance. The current financial system based around the hegemony of the US dollar dates back to the Bretton Woods Agreement signed on 22 July 1944. The chart for that event has a Stellium of planets in Leo including Venus, Pluto, Mercury, Jupiter and the Moon. Many of these planets are all going to be impacted by the Saturn Uranus Square this year. In fact the Bretton Woods Venus at 6 Leo is making a T Square to those planets right now and will be opposed by transiting Venus on 6-7 February 2021. I would expect further upsets throughout the current year and to see the whole financial system drastically changed once Pluto starts to track through Aquarius in the mid 2020s

Thats the question I have been asking if they were so flush with funds how come they didnt join the system … so today where did they get the funds to try to bring it down.

Over the past few decades, Wall Street has gone from researching and picking stocks that will perform well for dividend payments to figuring out where the market inefficiencies are and buying/selling short-term to make a profit.

The more computerised it’s got, the easier it is exploit inefficiencies. I’ve read about companies having their own highspeed broadband put in from Chicago to New York because with the microseconds it’ll save, their computer programs can buy/sell stocks before other companies do.

The fact is, Wall Street relies on the day traders and amateurs to create inefficiencies it can exploit. If everybody has the same information and experience, there is no inefficiency and therefore no profit.

Except this time, the amateurs banded together and exploited the hedge funds. And the big boys didn’t like getting beaten at their own game.

Now the hedgefunds know about the Reddit thread, they’ll be monitoring it. It was just a part of the market they weren’t taking notice of so they created the inefficiency by going in big on the expectation that Gamestop would fail.

Ultimately there is something morally reprehensible about betting on the failure of a company which is what short-selling is.

(PS Happened to watch The Big Short over the weekend. Great film and a reminder of how the GFC went down from 2006-08. All fuelled by the greed of the banks, brokers and a broken system. Very little has changed since. I’m left wondering if there’s another GFC due before Pluto exits Capricorn)

I’ve always thought Venus, rather than Mercury, rules stock market. This is because stock market value formation can be incredibly random, driven by “likes” rather than pure, cold numbers. Therefore, it’s not a coincidence that a financial tech company with Taurus Venus hit by Saturn in Aquarius square Uranus in Taurus, which struck me as a “Crackdown of Tech Industry” transit the first times I saw this on predictive charts years ago, is in the news.

I too have a lingering feeling traditional Wall Street will win this time, although looking at hedge fund managers talking about “unproductive sad young men” makes me feel they don’t get this entirely either, even being of generation who should at least know about Reddit. I think that by the time Uranus hits Gemini, there will be enough Millenials born after 1990 in positions of relevance to have online and offline spheres merged even in more conservative fields.

I thought stock markets were an 8th house thing. The investment is dependent on the performance of a company. The traders and brokers are investing other people’s money. Trading is all about bartering for price – there’s a negotiation going on between two parties. (Compare that to putting your money in the bank and getting interest which is simple and straightforward and therefore more Taurus/2nd)

Wall Street greed really began to take hold in the mid-80s when Pluto was in Scorpio. Although arguably you could say it’s connected to the Saturn-Pluto in Libra of 1982 which would be Venus again.

What do you think? Convincing arguments?

@GnarlyDude, I’d look at 8th house more as financial sector in general, because it comprises banking and real estate market – the single most effective generator of added value. Also, I actually had some notes on 7th house and the stock market somewhere, I may try to locate them.

That said, one of the best examples of a collective stock market rally is Finland in the late 1990’s. Using equal house – which I prefer here, because beyond 60th parallel, other systems will give you completely insane houses sometimes comprising up to 4 signs especially for midday or midnight charts around solstices -, Finland has an 8th house Venus 0′ Aquarius. It’s been majorly affected by outer planet passages in the 8th house in general. Last tr. Saturn in the 8th brought a banking crisis not unlike the one hitting Iceland in 2008. But most importantly, tr. Neptune conjunct Venus brought a stock market rally driven by Nokia, which was the largest cell phone manufacturer in the World in the late 1990’s and early 2000’s. The last years of 1990’s in particular saw several tech IPOs with people literally queueing to sign. Professional investors had a saying “When taxi drivers start to hype a stock, it’s time to get out”. Most companies did not succeed, but fortunately, people were not investing their whole fortune to this. And interestingly, many people who brought Nokia or used their employee options, but were slow to sell in the late 2000’s when dividends dropped drastically, got their money back thanks to WSB rally. I’ve worked with some OG Nokia devs whose project with their next employer was nixed recently. In case they still had their stock and sold it when the rally started, they would have looked at making 20-30 k. Honestly couldn’t havr happened to more deserving people.

This is classic Uranus in Taurus stuff as we approach the Saturn square and the planet lineup in Aquarius this month.

The South Sea Bubble, a kind of giant Ponzi scheme burst in the autumn of 1720 when Neptune was in Taurus opposing Saturn in Scorpio. At the same time there was an impressive lineup of planets in Venus ruled Libra – Sun, Mercury, Mars, Venus, Jupiter and Uranus.

That’s very interesting VF. You prompted me to look at the Tulip Fever phenomenon, where there was a frenzy of trading the bulbs, with their prices climbing ever higher until the Netherlands financial ‘bubble’ burst in February 1637. In 1636-7 Uranus in Libra was square Saturn in Capricorn. Jupiter sextiled Neptune in Scorpio in 1636, and was then trine Pluto in Taurus that winter as the fever climbed ever higher. By February 1637, Jupiter and Uranus were in Venus-ruled Libra, plus Pluto in Venus-ruled Taurus – gardens and flowers, as well as money mania? For the month of the collapse, Venus moved from Capricorn into Aquarius – as has just happened this month.

Oh yes, Tulip mania is a chapter in Charles MacKay’s ‘Madness of Crowds’ I think, Jane. The Taurus/Scorpio axis always seems to be activated during these financial crises, with a planetary emphasis in Venus ruled signs too. Now that Venus has gone into Aquarius, it’s worth observing financial events as she moves into square with Uranus in Taurus, thus forming an interesting mutual reception.

I do think the Stock Market needs more regulation and reform and it’s sobering to remember that the wealth gap has grown substantially for the last 25 years and with Uranus now in Taurus I believe it is vital that we think of new ways around wealth distribution. The ‘New Deal’ came into force in the States and is one example of a more progressive attitude which came into being the last time Uranus was in this sign.

It’s interesting to see the date for the ‘Bubble Act’ of 11th June, 1720 which made non chartered companies illegal. And was possibly passed in Parliament under pressure from the South Sea Bubble crew…

That day had Mercury and Venus conjunct in Taurus, trine Jupiter in Virgo. Neptune and BML were conjunct in Taurus. Uranus was in Libra, and Saturn opposing BML from Scorpio, where it trined Mars in Cancer – which must have felt a bit lost amidst all of that, trying to act in a security-loving way! However, it was sextile Neptune so may have been bamboozled. There’s a lunar eclipse at 27 Taurus in November this year, conjunct that Bubble Act Mercury. Although the word ‘bubble’ now has other connotations of course. But maybe some resonances with 1720 are possible. Certainly nobody has really addressed regulating and reforming the stock market casinos properly. It would be heartening to see some progress there, I agree.

Sorry to post again but I am so intrigued as to what’s going to happen. This situation. Ie the buying of gme stock frenzy is reminisent to me of the pyramid schemes in Albania in the 90’s, where eventually high numbers of ordinary people lost all their investment. Albania has never recovered financially.

@Xhsemercury, I have to disagree here in that people involved here are not entirely ignorant in finances the way 1990’s Albanians would have been. The subject was hardly spoken of, studied or taught in Albania for 50 years, and the only information “common” Albanians might have had any access to was through Italian television, with very little programming on subject. I distinctively noticed the difference in the late 1990’s, coming from a country where people were tapping to “Tech Bubble” and daily news casts had lengthy sections on stock market.

People involved in this are mostly much more sophisticated, and brought up by a real chance of making money. For instance, I know for the fact that many day traders around my neck of the wood made considerable amounts of money with Nokia Rally, as did others who’d gotten options in their portfolio, because they’d gotten options while working for the company, used them to buy stock and then had them “laying” there for 10 or more years.

The issue is that when the rally is over, there will always be losers, mostly people who hopped in too late, attracted by the hype.

@Solaia, Have you been to the wallstreetbets subreddit? The forum now has 7.7m subscribers. 2 weeks ago it was around 1m. This is the frenzy I referred to in my earlier post, which reminds me of Albania in the 90’s (the race to go all in with nothing to loose). Albanians saw other Albanians making huge profits, with some schemes offering a 30% return on investments; and as we know pyramid schemes only benefit those at the top. The Government even promoted these schemes and were to be in collusion with the schemes. The subreddit has many posts from people all over the world, not just the USA, saying they have bought shares in GME. It appears that many have invested what they can afford to loose; however, I’ve read other posts where they have literally gambled their life savings, one poster yesterday had spent his $25k college fund hoping to replicate what earlier investors, such as Roaring Kitty, who on paper has made $147m. The initial investors were on a moral crusade against Wall st / hedgefunds. They liked GME as a business and spent their money there. They were infuriated when wall st bet against GME. Also really important to note these are millennials with many of them being indirectly affected by the 2008 crash with Parents / grandparents loosing homes / savings / college funds because of their underhand schemes (astonishingly all legal). The initial investors are not selling their shares, as they say hold to the moon and back because they’ve got diamond hands. I couldn’t care less if these funds collapse or that a few wealthy peoples wealth is reduced. Hopefully, things are going to change for the better.

Also, the wallstreetbets subbreddit is not telling people to buy silver. This is a wall st manipulation. The theory is by manipulating the price of silver the hedge funds (own lots of silver) will be able to recoup their massive losses. Manipulation everywhere it seems.

Thanks marjorie. This has been fascinating to watch unfold on the subreddit wallstreetbets. It appears that many of the investors are prepared to loose all their money anyway! It is in principle, a millennial vs baby boomer stand off. Ie. uneven distribution of wealth and lack of opportunities motivating them. They refer to themselves as ‘autistic’. They also value gme as a business and did not want it to be decimated by wall st. Their motto is hold to the moon and back. The majority are not motivated by financial gain. Scary for wall st.

Exactly Xhsemercury

From what I read, a lot of the original Reddit investors only went in with $20 – $100 – an amount they were willing to lose. The whole point was to stick it to the squeeze the short sellers in the hedge funds. There were said to be 4 million people looking at the Reddit thread.

Once the short sellers understood what was happening, they had to buy stock to cover the losses they’d be incurring. And in doing that they pushed the price up each further.