The greed-is-good boys are still at it having learned zero from the 2008 crash. Global banks may face losses of $6 billion from the collapse of Archegos Capital, a little known firm that was using tons of borrowed money to make outsized bets that propped up media stocks. Its failure created shockwaves large enough to ripple across Wall Street — and impact everyday Americans’ retirement accounts.

“It’s a wake-up call. With leverage, comes risk,” said Art Hogan, chief market strategist at NSC. “This is the second time we’ve learned a lesson this year about leverage.” In January, another hedge fund, Melvin Capital Management, nearly collapsed after its massive bets against GameStop (GME) were blown up by an army of traders on Reddit. A financial analyst said: “it serves as a reminder of the dangers posed by extreme leverage, secret derivatives and rock-bottom interest rates.”

Bill Hwang who started Archegos in 2012 pleaded guilty to wire fraud and insider trading of Chinese bank stocks and agreed to pay $44 million to settle civil allegations. And investment banks still competed to extend his fund more than $50bn in credit, which was used to build up huge, non-public positions in a small number of stocks.

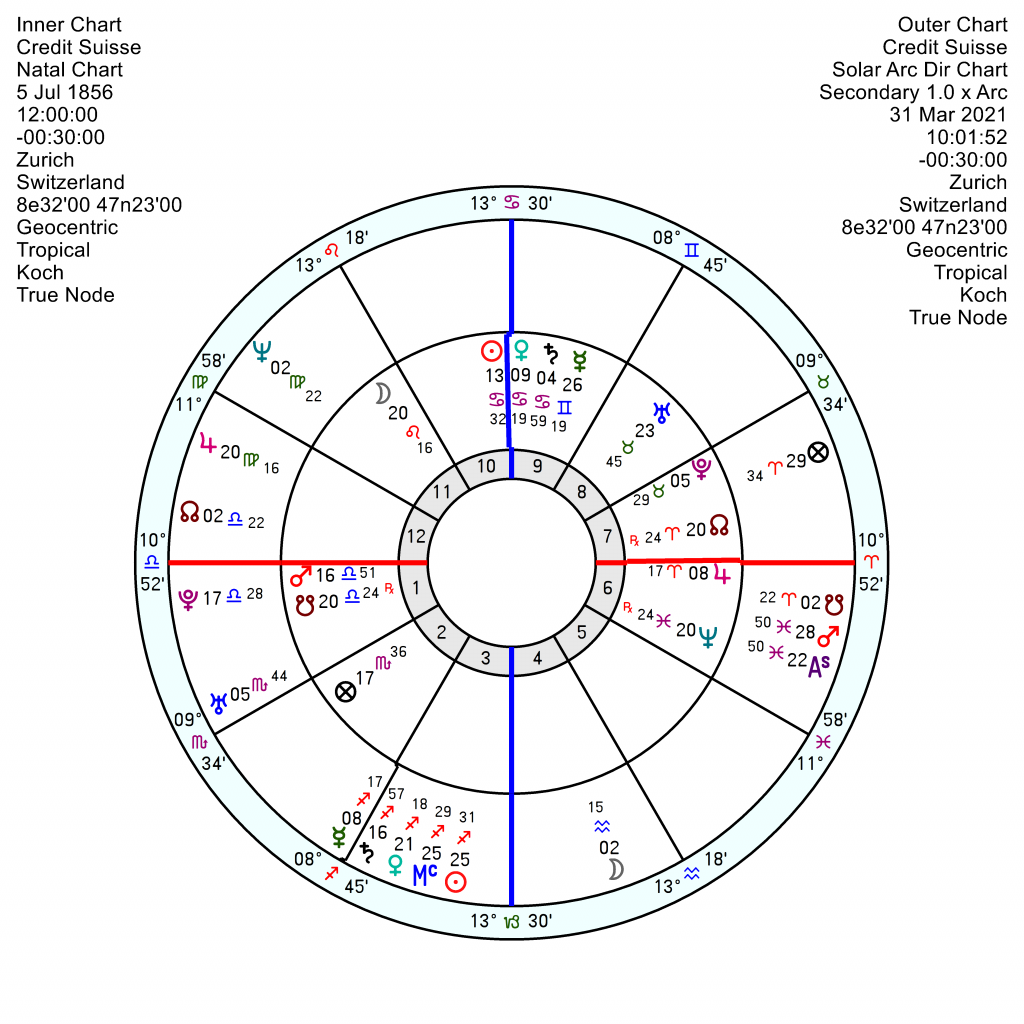

Credit Suisse is on the hook for this as well as for the Greensill collapse (see previous post 17 March 2021) and is hurting. It is still stuck in a scary corner from a recent Solar Arc Pluto conjunct Mars and now has a financial bubble-bursting Solar Arc Jupiter opposition Neptune – and most disruptive of all a turning-upside-down Solar Arc Uranus opposition the Pluto.

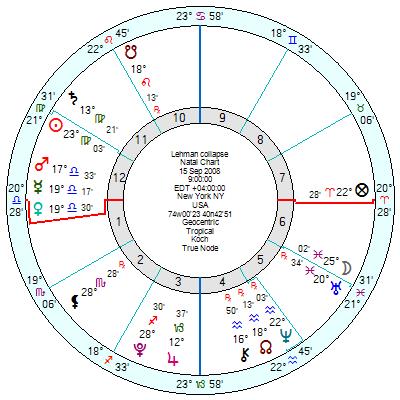

But the interest isn’t just one bank. The Lehman Brothers collapse which precipitated the 2008 crash – after a string of financial institution bankruptcies in 2007 – occurred on a Saturn opposition Uranus, not dissimilar to this year’s Saturn square Uranus extending into early 2022. Pluto was in the final degrees of Sagittarius poised to change sign; and Neptune in last decan Aquarius was at a degree that Saturn will reach in 2022.

This time round – even if money matters follow a roughly similar trajectory – it won’t be as cataclysmic as 2008 since Pluto’s entry into Capricorn was always going to blow a torpedo shaped hole below water in the financial systems. But it might suggest Pluto is attempting to tie up loose ends or rap knuckles one more time with timely warnings about the bottomless pit of avarice leading to perdition – and dragging everyone else down as well.

Marjorie you have such a superb way with words. Brilliant! Many tnaks as always.

FW

Just wanted to second this. I don’t comment here often but I do read just about daily. Thank you, Marjorie!

Greed… They never learn !!

Sounds like the perfect opportunity to give the honchos a massive bonus as they guide the company through a grave crisis. These financial companies never flinch in their greed. They hire the management types that accentuate this.

2008 they had windfall by bankruptcy fake filings which waived off their payback while permitted cutting jobs of working class while the owners enjoyed more windfall

2008 top wasn’t cleaned…which hopefully now will

Absolutely..greedy r always lazy…N I disagree with orr last line…not everyone.. just greedy

Thanks Marjorie – the global casino never learns much it seems. It’s interesting to look at the Credit Crisis of 1772, which began with the closure of two London banks in June, 1772. I think there are astrological echoes of what’s happening now.

June 1772 has Jupiter just into speculative Pisces. In June 2021, Jupiter reaches that same degree of Pisces. The 1772 Pluto is at 20 Capricorn, trine Uranus in Taurus at 21. There’s also a Uranus/Saturn square, with Saturn in Leo. Neptune is in mid Virgo.

Fascinating, thanks for sharing.