Neil Woodford, a few years ago described as the rock star of pensions and fund management, has lost his mojo. After 23 consecutive months in which withdrawals from his fund has been greater than the new money coming in, Woodford closed it to withdrawals for 28 days, causing concern amongst the tens of thousands whose pension savings and investments are at risk. His flagship fund at its peak worth more than £10 billion has shrunk to about a third of that.

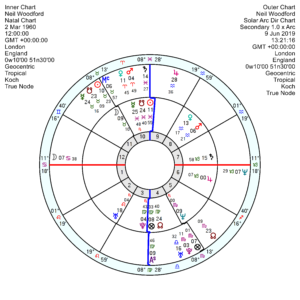

He was born 2 March 1960 and became renowned for his horse riding, Porsche driving and ostentatious lifestyle as well as his canny stock picks. He is a Sun Pisces opposition Pluto and trine Neptune, so has stratospheric ambitions. He has Fixed planets in all four signs – an indulgent Taurus Moon opposes Neptune square either Mars or Venus in Aquarius with Mars opposition Uranus. Fixed signs are acquisitive, especially a Taurus Moon; a strong Uranus is impulsive; and a visionary Neptune can be delusional. Though they do bring stamina and endurance.

He’s on his Second Saturn Return at the moment which usually brings a reality check; and his Solar Arc Sun had been opposing his Neptune as the slide began. He’ll be in for jolts, jangles and high insecurity from this July as tr Uranus squares his Mars, off and on into 2020 by which time tr Uranus opposes his Neptune so it’ll be a long nerve-stretched run. Though he’ll pick up a head of steam from late February 2020 as tr Pluto squares his Jupiter/Pluto midpoint running into 2021.

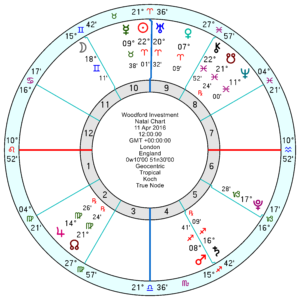

His most recent companies, set up on 11 April and 9 May 2016 – both kicked off with the head-in-the-clouds Jupiter opposition Neptune square Saturn and Mars in Sagittarius – so the ingredients for a bubble-burst with multiple setbacks was there from the start and exacerbated since then by Neptune moving by transit and Solar Arc to close aspects to exact. Plus the 11 April company had the unstable Sun Uranus in Aries square Pluto, which is under heavy assault from tr Pluto exactly now.

If it sounds too good to be true in the money arena – it usually is.

It’s very difficult to do something like he tried on his own, not the same as having the Invesco team behind you.